car lease tax deduction calculator

A lot of taxpayers choose the standard mileage deduction instead. When leasing a car privately you do not have any company car related taxes to consider.

This IRS rate reflects the average expense of operating a vehicle per year.

. Enter the amount from line 4 or line 5 whichever is more. Actual amount incurred by the employer. A leased car traveling 9000 miles in business is equivalent to a deduction of 5175 12000 miles 3000 personal and commuting miles 0575 IRS mileage.

The deduction limit in 2021 is 1050000. 7 For example lets say you spent 20000 on a new car for your business in June 2021. Another common reason is a lifestyle change.

When an employer talks about your salary they mean your basic starting salary. Example Calculation Using the Section 179 Calculator. In this case the formula will look like.

Car lease tax deduction calculator. Now add GST and PST to 800 and multiply that amount by the total number of days you leased your vehicle during the year and divide the total by 30. Monthly depreciation monthly interest tax rate monthly tax amount 22222 7980 00725 2190.

Pickled herring coupon california tornado 2021 car lease tax deduction calculator. Total lease payments deducted in fiscal periods before 2021 for the vehicle. For 2022 the standard mileage.

GST and PST on 800. Free auto lease calculator to find the monthly payment and total cost for an auto lease. Car lease tax deduction calculator 02 Apr.

You take the profit. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. If You Use A Passenger Vehicle To Earn Employment Income There Is A Limit On The Amount Of The Leasing Costs You Can Deduct.

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. Various components are then added to this number to create your final salary package. This calculator has been created to help come to a quick decision.

510 Business Use of Car. Posted at 2207h in meinl. 66 cents per kilometre for the 201718 201617 and 201516.

In 2022 your business may qualify for a potential federal income tax deduction up to 100 of the purchase price of a new qualifying Nissan truck or van purchased and placed in service in. Total lease charges incurred in 2021 fiscal period for the vehicle. Enter the total number of days the vehicle was leased in the tax year and previous years.

You use the car for business purposes. Tenants often find that. Answer 1 of 3.

To calculate your deduction multiply the number of. Enter the manufacturers list price. Now heres the equation to calculate the monthly tax amount.

You can claim a maximum of 5000 business kilometres per car.

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

Pros And Cons Of Leasing Or Buying A Car

Car Leasing Guide How To Lease A Vehicle Kelley Blue Book

Is It Better To Buy Or Lease A Car Taxact Blog

4 Ways To Calculate A Lease Payment Wikihow

How To Figure Out Your Monthly Car Lease Payment Yourmechanic Advice

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How To Calculate Lease Buyout Car Lease Buyout Galaxy Toyota

How To Profit From An Off Lease Car Kelley Blue Book

Is Your Car Lease A Tax Write Off A Guide For Freelancers

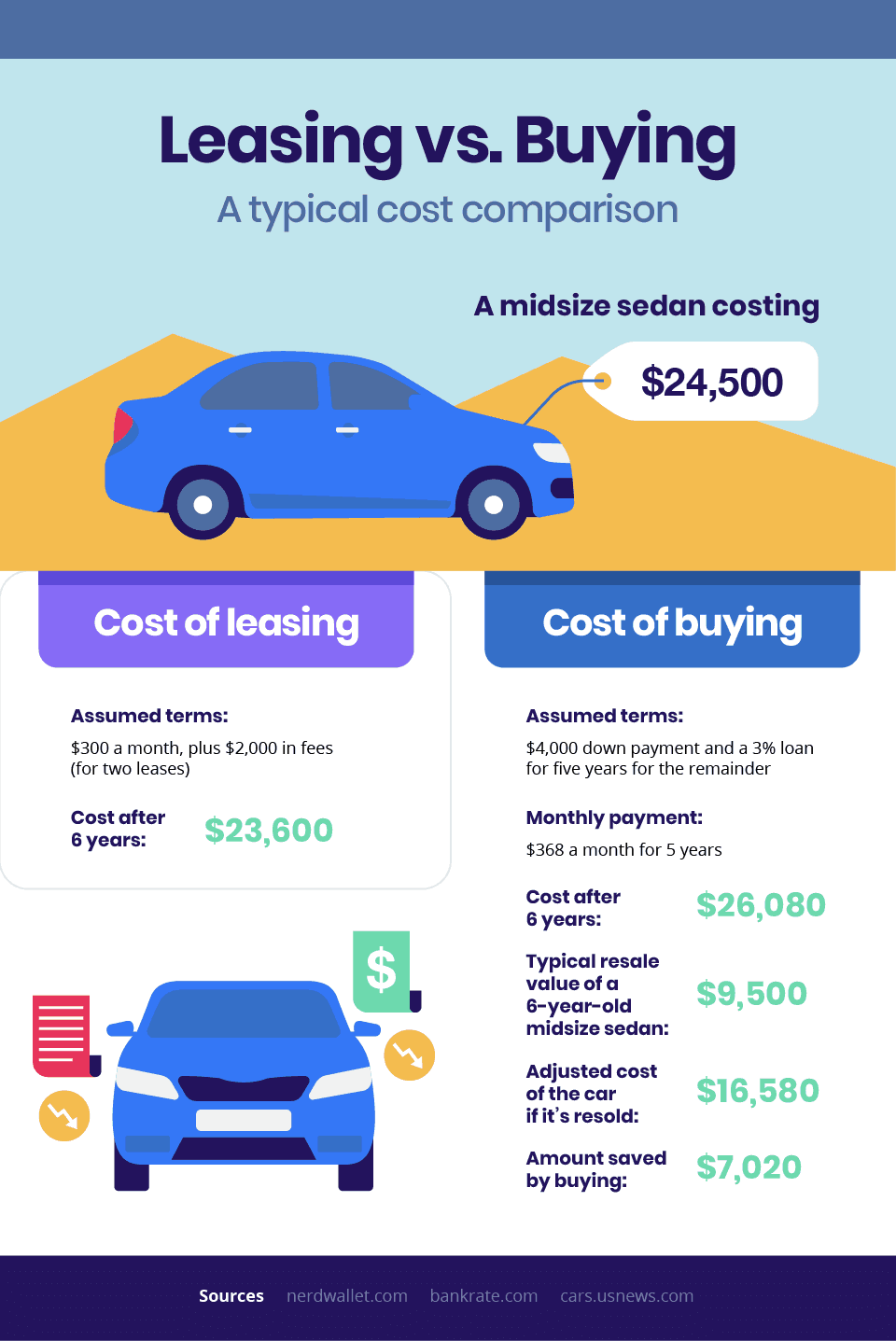

Buy Vs Lease Car Calculator Leasing Vs Buying A Car Calculator

Car Lease Ratings Guide Car Lease Tips

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Car Tax By State Usa Manual Car Sales Tax Calculator

Tax Department Of Motor Vehicles

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Lease Vs Buy Car Calculator Credit Karma